Wow.

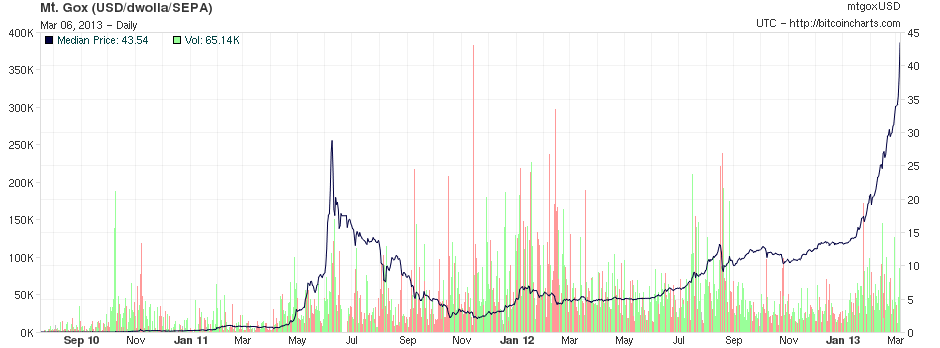

The bitcoin price over the last month or so has really gone crazy, as of today its up around $43USD/BTC. It’s hard to understand why it is so high given not a great deal has changed (other than the halving of the mining reward late last year and perhaps a little wider adoption)from when it was just under USD3 in November 2011 after its crash from previous highs around $30/BTC.

At the end of the day it really doesn’t matter what the price of a BTC is if its main purpose turns into being the “transport medium” of wealth from one individual to another, it is merely the conduit by which value is exchanged. If they are USD100 each or USD1 each it will only mean that the person sending the $$$ to someone else needs to buy more or less of them. The problem with this wild fluctuation in value is that the majority of people who want to buy to store value and to later exchange for goods or services in the medium term are likely to be to nervous to do so given its volatility and as a result the usage of bitcoin as a stored value and accordingly to be used as exchange for goods or services could be limited

Perhaps bitcoin will be relegated to just a short term transfer of wealth vehicle, quickly bought, sent to another wallet and then converted back into the local currency of the receiver before any swings in the exchange rate adversely impacts the recipient.

We will no doubt see soon what happens.