I have been thinking more about Bitcoin and what it could be used for and why the exchange rate of Bitcoin may actually mean very little in the real world. Here is what I think.

Given there is relatively few places that are actually accepting Bitcoin to purchase their goods the only thing I can think of that Bitcoin is good for is to store value; anonymously!

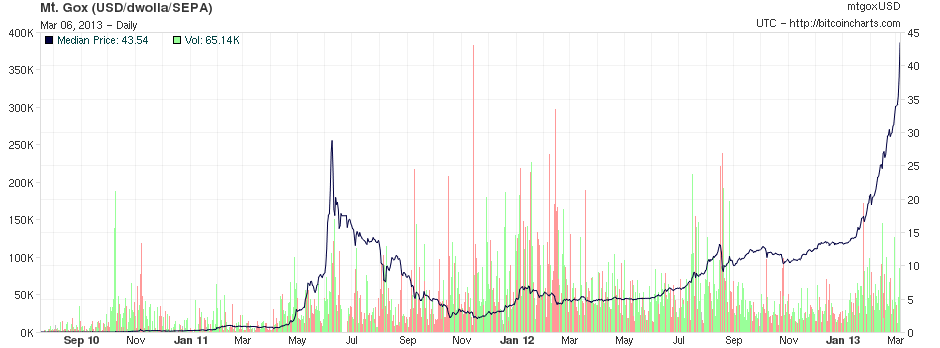

Lets pretend I’m a crook and I want to launder money that I have gotten through less than honest means, I could purchase Bitcoins through a place like MtGox and hold it there for a period of time and then either exchange it back to USD – or what ever the currency you purchased it for in the beginning.

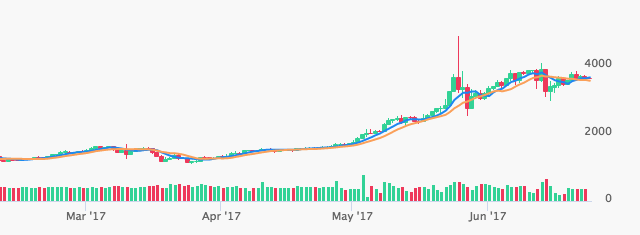

In the above situation it doesn’t really matter what the exchange rate is when you buy Bitcoins, it could be USD1000 for each Bitcoin, as long as the exchange rate doesn’t move against you when it comes time to change it back to a common currency you are OK; in fact the higher the exchange rate the better because the percentage change would reduce if the rate was fluctuating by a few dollars up and down. To explain, at USD10/BTC a $2 change is a movement of ±20%, the the exchange rate was USD1000/BTC a movement of $2 is only ±0.20%. Now, sure the $ value may also be moving by large $$ values but up and down $200 would appear to the market as fairly extreme.

Further, I would even think that given the funds being laundered were ill gotten perhaps the launderer (if there is such a word) is prepared to take a hit of a certain % because, lets face it, they probably stole it to begin with.

The other explanation is that there are a bunch of guys (and girls) ripping each other off for fun, kind of like a game of musical chairs, and who ever holds the Bitcoin at the end of the game actually looses (because you have been the one most ripped off).

These are just my thoughts that help explain the exchange rate crazy-ness going on. No doubt there is some dodgy-ness going on by someone in the back ground driving the rate up anyway.